Intermediate Accounting 18th Edition PDF: A Comprehensive Guide

Intermediate Accounting’s 18th edition provides a robust foundation in accounting principles, offering detailed coverage and practical applications.

Numerous resources, including PDF versions and solution manuals, are available to aid students and professionals alike in mastering complex financial concepts.

What is Intermediate Accounting?

Intermediate Accounting bridges the gap between introductory financial accounting and more advanced accounting courses. It delves into the intricacies of financial reporting, moving beyond basic principles to explore the ‘why’ behind accounting rules. This course, often taken by junior- or senior-level accounting students, focuses on applying Generally Accepted Accounting Principles (GAAP) – and increasingly, International Financial Reporting Standards (IFRS) – to real-world business scenarios.

The subject matter encompasses a wide range of topics, including asset valuation, revenue recognition, liability accounting, and equity transactions. Students learn to prepare and analyze financial statements, understand the impact of accounting policies, and critically evaluate financial information. The 18th Edition, authored by Kieso, Weygandt, and Warfield, builds upon this foundation, offering updated content reflecting current accounting standards and practices. Access to a PDF version allows for convenient study and portability, while solution manuals provide valuable support for problem-solving and comprehension.

Essentially, Intermediate Accounting equips students with the analytical skills necessary to navigate the complexities of the financial reporting landscape, preparing them for professional roles in accounting, auditing, and finance.

The 18th Edition: Key Updates and Changes

The 18th Edition of Intermediate Accounting by Kieso, Weygandt, and Warfield incorporates several significant updates to reflect the evolving accounting landscape. These changes primarily focus on aligning with the latest accounting standards issued by the FASB and the IASB. Updates include enhanced coverage of topics like revenue recognition (ASC 606), lease accounting (ASC 842), and financial instruments.

Furthermore, the edition features revised examples and problem materials to provide students with practical application of these new standards. Increased emphasis is placed on data analytics and its role in financial reporting, preparing students for the demands of modern accounting professions. The PDF version of the textbook benefits from these revisions, offering students access to the most current information.

Instructors also benefit from updated solution manuals and test banks, ensuring alignment between teaching materials and the latest content. The 18th Edition aims to provide a comprehensive and relevant learning experience, equipping students with the skills needed to succeed in a dynamic accounting environment.

Authors: Donald E. Kieso, Jerry J. Weygandt, and Terry D. Warfield

Donald E. Kieso, Jerry J. Weygandt, and Terry D. Warfield are highly respected figures in the field of accounting education, renowned for their collaborative work on Intermediate Accounting. Kieso, a professor emeritus, brings extensive research and practical experience to the textbook; Weygandt, also a distinguished professor, is celebrated for his clear and concise writing style, making complex concepts accessible to students.

Warfield contributes his expertise in financial reporting and analysis, ensuring the textbook remains current and relevant. Their combined experience and dedication to accounting education have made Intermediate Accounting a leading textbook for generations of students. The 18th Edition PDF reflects their commitment to providing a comprehensive and accurate resource.

The authors’ meticulous attention to detail and commitment to pedagogical best practices are evident throughout the textbook and accompanying solution manuals. Their work continues to shape the education of future accounting professionals, solidifying their legacy in the field.

Availability of the PDF Version

The Intermediate Accounting 18th Edition PDF version isn’t typically offered for free direct download from official sources like Wiley. Access usually requires a purchase through authorized retailers or bundled with digital learning platforms. However, various online platforms may host unofficial copies, raising concerns about legality and security.

Students often gain access through university libraries offering digital textbook resources, or via course packs provided by instructors. WileyPLUS, Wiley’s digital learning environment, provides access to the textbook in a digital format, though not always a downloadable PDF. Purchasing the PDF directly from Wiley ensures a legitimate, properly formatted copy.

Be cautious of websites offering free downloads, as these may contain malware or outdated versions. Always prioritize official sources to guarantee the accuracy and integrity of the material, especially when relying on the solution manual for study purposes. Verify the source before downloading any digital textbook.

Legality and Ethical Considerations of PDF Downloads

Downloading a PDF of Intermediate Accounting 18th Edition from unauthorized sources presents significant legal and ethical concerns. Copyright law protects the intellectual property of authors Donald E. Kieso, Jerry J. Weygandt, and Terry D. Warfield, and Wiley as the publisher. Obtaining the textbook through unofficial channels constitutes copyright infringement, potentially leading to legal repercussions.

Ethically, supporting authors and publishers by purchasing legitimate copies ensures the continued production of high-quality educational materials. Utilizing illegally downloaded PDFs undermines this system and devalues the work of those involved in creating the textbook and its accompanying solution manual.

Furthermore, unauthorized PDFs may contain viruses or malware, compromising your device’s security. Prioritizing legal acquisition methods – purchasing from Wiley or authorized retailers – safeguards both your ethical standing and digital safety. Respecting copyright fosters a sustainable learning environment for all.

Where to Find the Official PDF (Wiley Website)

The most reliable and legally sound method to acquire the Intermediate Accounting 18th Edition PDF is directly through the Wiley website. Wiley, the official publisher, offers various purchase options, including individual chapters or the complete textbook in PDF format. Visiting their site guarantees you receive an authentic, high-quality version free from potential malware or copyright infringements.

Navigating the Wiley website allows you to explore bundled packages that may include the PDF, access to WileyPLUS digital learning resources, and potentially the solution manual. These bundles often provide a cost-effective solution for comprehensive study.

Ensure you are on the official Wiley domain to avoid fraudulent websites. Look for secure payment gateways and clear copyright information. Purchasing directly from Wiley supports the authors – Kieso, Weygandt, and Warfield – and ensures continued updates and quality control for future editions. Accessing the official PDF provides a legitimate learning experience.

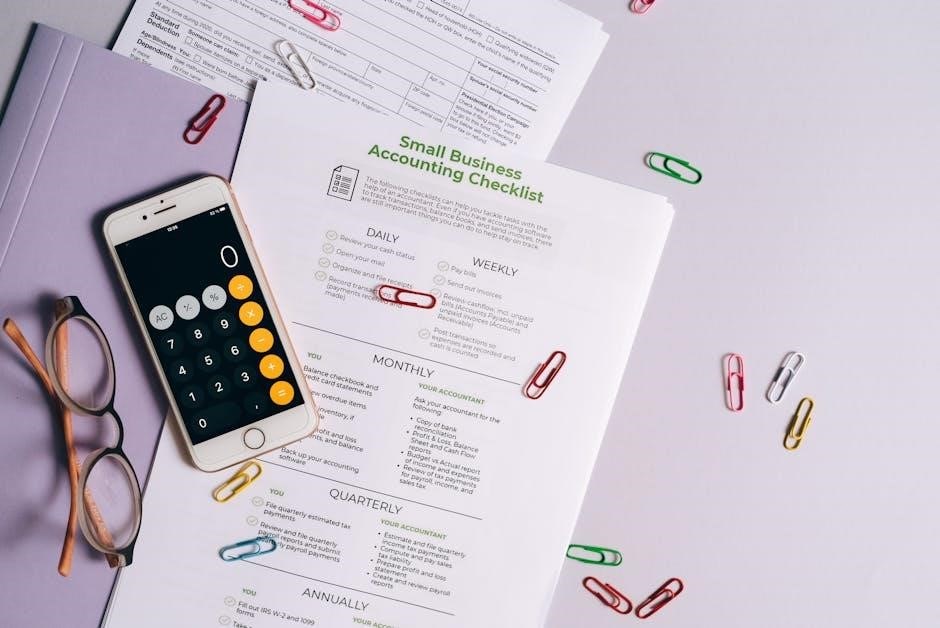

Solution Manual for Intermediate Accounting 18th Edition

A Solution Manual for the Intermediate Accounting 18th Edition, authored by Kieso, Weygandt, and Warfield, is a crucial resource for students seeking to deepen their understanding of the material. This manual provides detailed, step-by-step solutions to end-of-chapter problems and exercises, offering valuable insights into the application of accounting principles.

Available for chapters 1 through 23, the solution manual assists in identifying areas where students may struggle and reinforces correct problem-solving techniques. It’s often sold as a bundle with the textbook or as a separate purchase. Several online platforms, like Docsity, advertise access to these materials in PDF format.

Instructors also utilize the solution manual for grading and lesson planning. However, it’s vital to obtain a legitimate copy to respect copyright laws and support the authors. Utilizing the solution manual alongside the textbook enhances learning and exam preparation.

Benefits of Using the Solution Manual

Employing a Solution Manual alongside Intermediate Accounting 18th Edition offers significant advantages for students. It transcends simply providing answers; it illuminates the process of arriving at those solutions, fostering a deeper comprehension of complex accounting concepts. Students can pinpoint specific areas of weakness and focus their study efforts accordingly.

The manual serves as an invaluable self-study tool, allowing independent practice and reinforcing classroom learning. It’s particularly helpful when tackling challenging problems or preparing for examinations. By comparing their work to the detailed solutions, students can identify and correct errors in their approach.

Furthermore, the Solution Manual builds confidence and promotes critical thinking skills. Access to these resources, often in PDF format, empowers students to take ownership of their learning and achieve academic success in Intermediate Accounting.

Chapter-by-Chapter Breakdown of the Solution Manual

The Solution Manual for Intermediate Accounting 18th Edition, by Kieso, Weygandt, and Warfield, is meticulously organized, mirroring the textbook’s structure. It provides comprehensive solutions for all end-of-chapter problems, including those categorized as simple practice, cases, and comprehensive problems. Chapters 1 through 23 are fully covered, offering detailed step-by-step explanations.

Each chapter’s solutions begin with a restatement of the problem, ensuring clarity. Subsequent steps demonstrate the correct application of accounting principles, often including supporting calculations and justifications. The manual doesn’t merely present answers; it explains the reasoning behind them.

Available in PDF format, the breakdown allows targeted assistance. Students can quickly locate solutions for specific exercises, enhancing their self-study efficiency. This granular approach is invaluable for mastering the nuances of each accounting topic presented in the 18th edition.

Test Bank and its Relation to the Textbook

The Test Bank accompanying Intermediate Accounting 18th Edition serves as a crucial assessment tool, directly aligned with the textbook’s content. It comprises a diverse range of question types – multiple-choice, true/false, and problem-solving – designed to evaluate students’ comprehension of each chapter’s key concepts. The questions are crafted to mirror the difficulty and scope of those found in actual examinations.

Unlike the Solution Manual, which provides answers to textbook problems, the Test Bank focuses on independent assessment. It allows instructors to gauge student understanding and identify areas requiring further clarification. The questions often require application of principles, not just rote memorization.

Available alongside the textbook and PDF versions, the Test Bank is a valuable resource for self-assessment. Students can utilize it to practice and prepare for quizzes and exams, reinforcing their grasp of Intermediate Accounting principles. All 23 chapters are covered and verified for accuracy.

Using the Test Bank for Exam Preparation

Effectively utilizing the Test Bank for the Intermediate Accounting 18th Edition is paramount for successful exam preparation. Begin by completing questions after each chapter, treating them as a diagnostic tool to pinpoint areas of weakness. Don’t simply check answers; analyze why incorrect responses occurred, revisiting the relevant textbook sections and potentially the solution manual for clarification.

Simulate exam conditions by timing yourself and working through sets of questions without referring to the book. Focus on understanding the underlying concepts rather than memorizing solutions. The Test Bank’s varied question types – multiple-choice, problem-solving – mirror the format of most accounting exams.

Leverage the Test Bank alongside the PDF version of the textbook for convenient study access. Regularly reviewing previously missed questions reinforces learning. Consider forming study groups to discuss challenging problems and share insights. Consistent practice with the Test Bank builds confidence and improves performance.

International Financial Reporting Standards (IFRS) Coverage

The Intermediate Accounting 18th Edition significantly expands its coverage of International Financial Reporting Standards (IFRS), recognizing the globalization of financial reporting. The PDF version of the textbook incorporates numerous examples and case studies illustrating IFRS application, alongside US GAAP. This dual approach allows students to develop a comparative understanding of both frameworks.

Dedicated sections within each chapter highlight the key differences between IFRS and GAAP, promoting critical thinking and analytical skills. The text provides detailed explanations of IFRS standards, ensuring clarity and comprehension. Accessing the solution manual can further aid in understanding complex IFRS calculations and interpretations.

Students preparing for careers in international accounting or those seeking a broader perspective will find the IFRS coverage invaluable. The 18th edition’s commitment to IFRS ensures relevance in today’s interconnected global economy, supplementing the core accounting principles presented in the PDF.

Financial Reporting Framework in the 18th Edition

The Intermediate Accounting 18th Edition meticulously outlines the current financial reporting framework, emphasizing the conceptual framework as the foundation for standard-setting. The PDF version presents a comprehensive overview of the objectives of financial reporting, qualitative characteristics of useful financial information, and the elements of financial statements.

This edition delves into the roles of the SEC and the FASB in establishing accounting standards, providing students with a clear understanding of the regulatory landscape. Detailed discussions on the accounting cycle, including journal entries, ledger accounts, and financial statement preparation, are included. Utilizing the accompanying solution manual reinforces comprehension of these core concepts.

The 18th edition’s framework coverage is designed to equip students with the ability to analyze and interpret financial statements effectively. Access to the PDF allows for convenient study and reference, while the emphasis on practical application ensures students can confidently navigate real-world accounting challenges.

WileyPLUS and Digital Learning Resources

WileyPLUS serves as a crucial digital companion to the Intermediate Accounting 18th Edition, enhancing the learning experience beyond the PDF textbook. It offers interactive assignments, practice quizzes, and immediate feedback, solidifying understanding of complex accounting principles. Students benefit from access to a wealth of online resources designed to reinforce key concepts.

The platform integrates seamlessly with the textbook, providing a dynamic learning environment. Digital tools include algorithmic practice, video explanations, and interactive simulations. These resources cater to diverse learning styles, ensuring students grasp the material effectively. The solution manual often complements WileyPLUS assignments, aiding in problem-solving.

Furthermore, WileyPLUS provides instructors with valuable data analytics to track student progress and identify areas needing improvement. This allows for targeted instruction and personalized support. Accessing the PDF alongside WileyPLUS creates a comprehensive and engaging learning ecosystem.

Common Issues Encountered with PDF Versions (Formatting, Accessibility)

While the Intermediate Accounting 18th Edition PDF offers convenient access, users often encounter formatting inconsistencies. Complex layouts, including tables and figures, may render incorrectly depending on the PDF viewer and device. This can hinder readability and comprehension of crucial financial data presented within the textbook.

Accessibility can also be a significant concern. Scanned PDF versions, in particular, may lack proper text recognition (OCR), making them inaccessible to screen readers used by visually impaired students. Even digitally created PDFs might not adhere to accessibility standards, posing challenges for inclusive learning.

Furthermore, large file sizes can lead to slow download speeds and compatibility issues with older devices. Security risks associated with downloading PDFs from unofficial sources are also prevalent. Utilizing the official Wiley website PDF, alongside a reliable solution manual, minimizes these potential problems and ensures a quality learning experience.

Alternatives to Purchasing the PDF (Library Access, Older Editions)

For students seeking cost-effective options, exploring alternatives to purchasing the Intermediate Accounting 18th Edition PDF is prudent. University and college libraries frequently stock physical copies of the textbook, providing free access to enrolled students. This eliminates the need for a digital purchase and offers a traditional learning experience.

Considering older editions, such as the Intermediate Accounting 2014 FASB version, can also be financially beneficial. While some updates may exist, core accounting principles remain consistent, making earlier editions viable for foundational understanding. However, be mindful of potential discrepancies in examples or specific regulations.

Furthermore, exploring textbook rental services or used book markets can significantly reduce costs. Accessing digital resources through WileyPLUS, even for a limited time, might offer a more affordable alternative than a full PDF purchase. Remember to weigh the benefits of the latest edition against budgetary constraints when making a decision.