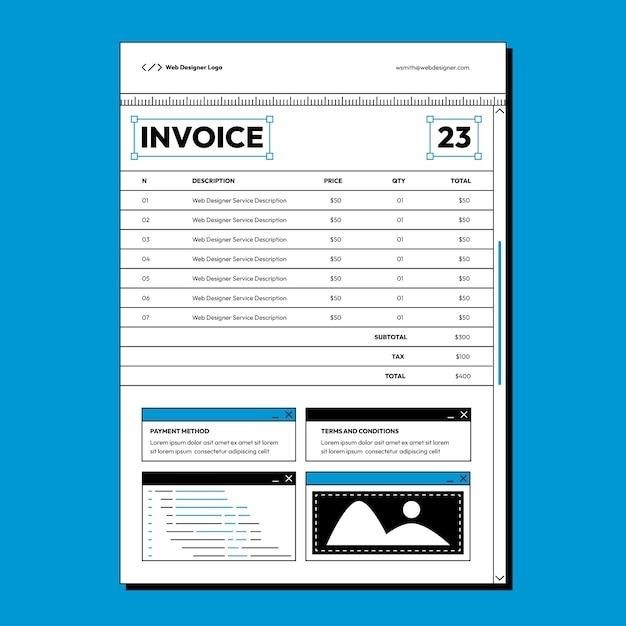

Invoice Filetype⁚ PDF

PDF (Portable Document Format) is a widely used file format for invoices due to its ability to preserve the original formatting and layout of the document, regardless of the operating system or software used to open it. This ensures that the invoice appears as intended, with all the necessary information and branding intact. PDF invoices are also easily shareable and can be securely sent electronically, making them a convenient and efficient option for businesses.

What is an Invoice?

An invoice is a formal document issued by a seller to a buyer detailing the products or services provided, their quantities, agreed-upon prices, and payment terms. It acts as a request for payment and serves as a record of the transaction. The invoice typically includes essential information such as the seller’s and buyer’s details, invoice date, invoice number, a description of the goods or services, unit prices, total amount due, and payment instructions. Invoices play a crucial role in businesses, serving as proof of purchase, facilitating financial tracking, and ensuring timely payment. They are essential for maintaining accurate accounting records and managing cash flow effectively.

Types of Invoices

Invoices can be categorized based on their purpose and format. Common types include⁚

- Commercial Invoice⁚ Used for international trade transactions, detailing goods shipped, quantities, prices, and payment terms. It’s crucial for customs clearance.

- Pro Forma Invoice⁚ A preliminary invoice sent before goods are shipped, outlining the estimated cost and terms of sale. Often used for obtaining financing or securing a purchase order.

- Recurring Invoice⁚ Issued for recurring services or subscriptions, typically with a set payment frequency (e.g., monthly, quarterly). These invoices often have predefined terms and amounts.

- Credit Invoice⁚ Issued when a customer purchases goods or services on credit, with payment due at a later date. It includes credit terms and may reflect a discount for early payment.

- Tax Invoice⁚ Used in jurisdictions with value-added tax (VAT) or goods and services tax (GST) systems. These invoices detail the applicable taxes and are essential for claiming tax deductions.

The specific type of invoice used depends on the nature of the transaction, industry standards, and legal requirements.

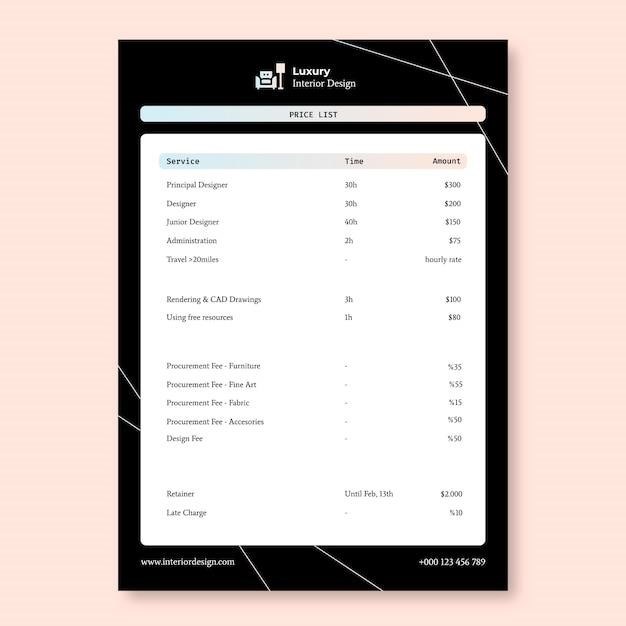

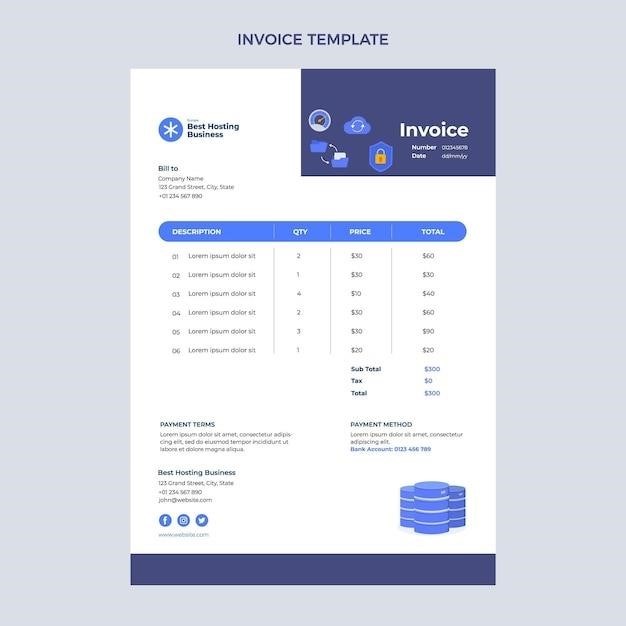

Invoice Elements

A well-structured invoice includes essential information for clear communication and accurate record-keeping. Key elements typically found on an invoice include⁚

- Invoice Number⁚ A unique identifier for the invoice, allowing for easy tracking and referencing.

- Invoice Date⁚ The date the invoice was issued, indicating the period covered by the charges.

- Seller Information⁚ Includes the seller’s name, address, contact details, and often their tax identification number (TIN).

- Buyer Information⁚ Contains the buyer’s name, address, and contact details. This ensures accurate delivery of the invoice.

- Itemized Description⁚ A detailed list of the goods or services provided, including quantities, descriptions, unit prices, and total amounts for each item.

- Subtotal⁚ The total cost of all items before taxes and discounts are applied.

- Tax Breakdown⁚ If applicable, a separate section detailing the different types of taxes applied (e.g;, VAT, GST) and their corresponding amounts.

- Discounts⁚ Any discounts or promotions applied to the invoice amount are clearly stated.

- Total Amount Due⁚ The final amount owed by the buyer, including all taxes, discounts, and the subtotal.

- Payment Terms⁚ Specifies the payment method, due date, and any associated penalties for late payment.

Additional elements, such as purchase order numbers, shipping details, or specific notes, may be included depending on the industry and transaction.

Invoice PDF Format

PDF invoices are typically created and saved in a standard PDF format that ensures compatibility across different operating systems and software. The PDF format offers several advantages for invoices, including⁚

- Preservation of Formatting⁚ PDF retains the original formatting of the invoice, ensuring that all elements, including fonts, images, and layouts, are displayed correctly, regardless of the viewer’s system or software.

- Security⁚ PDF files can be password-protected, limiting access to authorized individuals and preventing unauthorized modifications. This is especially important for invoices containing sensitive financial information.

- Searchability⁚ PDFs allow for text search capabilities, making it easy to find specific information within the document, such as invoice numbers or item descriptions.

- Compression⁚ PDF compresses the invoice data, reducing file size and facilitating efficient transmission and storage.

- Digital Signatures⁚ PDFs can be digitally signed to verify the authenticity and integrity of the invoice, ensuring that it hasn’t been tampered with.

These features make PDF a highly suitable format for invoices, ensuring clear communication, security, and ease of access.

Benefits of PDF Invoices

PDF invoices offer numerous benefits for both businesses and their clients, making them a popular choice for billing and payment processes. Some key advantages include⁚

- Professional Appearance⁚ PDF invoices present a professional and polished image, enhancing brand perception and reflecting a commitment to quality.

- Easy Sharing and Distribution⁚ PDF invoices can be easily shared electronically via email, file-sharing platforms, or online payment systems, eliminating the need for printing and physical delivery.

- Improved Security⁚ PDF invoices can be password-protected, preventing unauthorized access and ensuring the confidentiality of sensitive financial information. Digital signatures further enhance security by verifying the authenticity of the document.

- Reduced Costs⁚ PDF invoices eliminate the need for printing and postage, saving businesses time and money. They also streamline the billing process, reducing administrative overhead and improving efficiency.

- Enhanced Collaboration⁚ PDF invoices facilitate collaboration between businesses and their clients. Clients can easily view, download, and share invoices with their internal teams, promoting smooth communication and timely payments.

These benefits demonstrate the value of PDF invoices in today’s digital business environment, fostering efficiency, security, and a positive customer experience.

Creating Invoices in PDF Format

Creating PDF invoices is a straightforward process, often achieved using various methods and tools. Here are some common approaches⁚

- Invoice Software⁚ Dedicated invoicing software, such as Zoho Invoice, QuickBooks Online, or Xero, often provides the option to generate invoices in PDF format. These platforms offer templates, customization features, and automated workflows to simplify the process.

- Spreadsheet Software⁚ Spreadsheet programs like Microsoft Excel or Google Sheets can be used to create invoices. Once the invoice is designed, it can be saved as a PDF file. This method allows for basic formatting and customization, although it may require more manual effort.

- Online Invoice Generators⁚ Numerous online invoice generators, such as Invoice Generator, Invoice Simple, and Invoice Ninja, offer free or subscription-based services to create professional-looking PDF invoices. These tools often provide customizable templates and features for branding, payment options, and more.

- Word Processors⁚ Word processors like Microsoft Word or Google Docs can be used to create invoices. Once the invoice is designed, it can be exported as a PDF file. This method offers flexibility in formatting and layout, but may require more manual effort compared to dedicated invoicing software.

Choosing the right method depends on the specific needs of your business, budget, and desired level of customization.

Invoice PDF Software

A variety of software solutions cater specifically to the creation and management of PDF invoices, offering features that streamline the invoicing process and enhance efficiency. These software options can range from basic invoice generators to comprehensive accounting platforms with integrated invoicing capabilities.

- Dedicated Invoicing Software⁚ Zoho Invoice, QuickBooks Online, and Xero are prominent examples of dedicated invoicing software. These platforms provide user-friendly interfaces, customizable templates, automated workflows, and often include features for tracking payments, managing expenses, and generating reports.

- Accounting Software with Invoicing⁚ Popular accounting software, such as FreshBooks, Xero, and QuickBooks, commonly integrate invoicing capabilities. These platforms allow for the creation of professional-looking PDF invoices alongside other accounting functionalities.

- Online Invoice Generators⁚ Invoice Generator, Invoice Simple, and Invoice Ninja are examples of online invoice generators that provide free or subscription-based services. These tools often offer a range of customizable templates, payment processing options, and features for tracking payments and managing invoices.

The choice of invoice PDF software depends on the specific needs of your business, the desired level of functionality, and the budget allocated.

Invoice PDF Security

Securing PDF invoices is crucial to protect sensitive financial information and prevent unauthorized access or alterations. Several methods contribute to safeguarding PDF invoices, ensuring their integrity and authenticity.

- Password Protection⁚ Implementing a password on PDF invoices restricts access, preventing unauthorized individuals from viewing or editing the document. This simple measure adds an initial layer of security.

- Digital Signatures⁚ Digital signatures provide an electronic authentication method that verifies the sender’s identity and confirms the document’s integrity. They use encryption to ensure that the invoice hasn’t been tampered with since it was signed.

- Encryption⁚ Encrypting PDF invoices using strong encryption algorithms like AES-256 makes it difficult for unauthorized individuals to access the information. This helps to prevent data breaches and ensures confidentiality.

- Restricted Permissions⁚ Controlling the permissions on PDF invoices allows you to limit what users can do with the document, such as preventing printing, editing, or copying. This can be a valuable security measure for sensitive information.

Adopting these security measures for PDF invoices helps protect your business, your clients, and the financial data involved in transactions.

Invoice PDF Compliance

Ensuring that PDF invoices comply with relevant regulations and standards is vital for businesses, as it helps avoid legal issues, penalties, and ensures smooth transactions. Compliance requirements vary depending on the industry, region, and specific regulations in place; For instance, some countries mandate electronic invoicing, requiring specific formats and data fields.

- Tax Regulations⁚ PDF invoices should adhere to tax laws, including VAT (Value Added Tax) and GST (Goods and Services Tax). This might involve specific data requirements, such as the tax identification number and the breakdown of taxes applied.

- Industry Standards⁚ Certain industries, like healthcare or financial services, may have specific standards for electronic invoices. These standards could relate to data security, encryption, and the format of the invoice itself.

- Accessibility⁚ PDF invoices should be accessible to individuals with disabilities. This involves adhering to accessibility guidelines, like providing alternative text descriptions for images and ensuring the document can be read by screen readers.

- Data Protection⁚ Compliance with data protection laws, such as GDPR (General Data Protection Regulation), is essential. This involves ensuring that personal information is handled securely and that individuals have control over their data.

Businesses should familiarize themselves with the relevant regulations and standards applicable to their industry and region to ensure their PDF invoices are compliant.

Invoice PDF Best Practices

Following best practices for PDF invoices helps create professional, efficient, and easily digestible documents. By adhering to these guidelines, businesses can ensure that their invoices are clear, accurate, and readily accepted by clients.

- Clear and Concise Layout⁚ Use a clean, organized layout with clear headings and easy-to-read fonts. Avoid excessive clutter or extraneous information. Ensure all essential details, such as invoice number, date, client name, and payment terms, are prominently displayed.

- Branding and Professionalism⁚ Incorporate your company logo and branding elements to enhance the visual appeal and professionalism of the invoice. Maintaining a consistent brand image across all invoices strengthens your brand identity.

- Accurate and Detailed Information⁚ Include all necessary information, such as item descriptions, quantities, unit prices, and total amounts. Avoid errors and ensure the accuracy of all data.

- Payment Information⁚ Clearly indicate the payment methods accepted, bank details, and any relevant information for making payments. Ensure that payment instructions are concise and easy to follow.

- Security and Encryption⁚ Consider using password protection or encryption to safeguard sensitive information contained within the PDF invoice, particularly when sending invoices electronically.

- Accessibility⁚ Ensure the invoice is accessible to individuals with disabilities. This involves using a consistent font size, providing alternative text descriptions for images, and making the document compatible with screen readers;

By following these best practices, businesses can create professional and effective PDF invoices that streamline their billing process and enhance their brand image.

Invoice PDF FAQs

Frequently asked questions about PDF invoices can help clarify common concerns and provide guidance on best practices. Here are some of the most frequently asked questions about PDF invoices⁚

- What are the benefits of using PDF invoices? PDF invoices offer several advantages, including preserving formatting and layout across different platforms, ensuring document security, and enabling easy sharing and storage.

- Can I customize PDF invoices? Yes, PDF invoices can be customized to include your company logo, branding, and specific invoice layouts. Many invoicing software solutions offer templates and customization options for creating professional PDF invoices.

- How do I ensure that PDF invoices are accessible? Accessibility is crucial for PDF invoices. Consider using a consistent font size, providing alternative text descriptions for images, and ensuring compatibility with screen readers.

- How do I send a PDF invoice securely? Securely sending PDF invoices is essential for protecting sensitive information. Utilize password protection, encryption, or secure file transfer methods.

- Are there any legal requirements for PDF invoices? Legal requirements for PDF invoices vary depending on your location and industry. Consult relevant laws and regulations to ensure compliance.

If you have any additional questions about PDF invoices, consult online resources, industry guides, or seek professional advice.